Award-winning PDF software

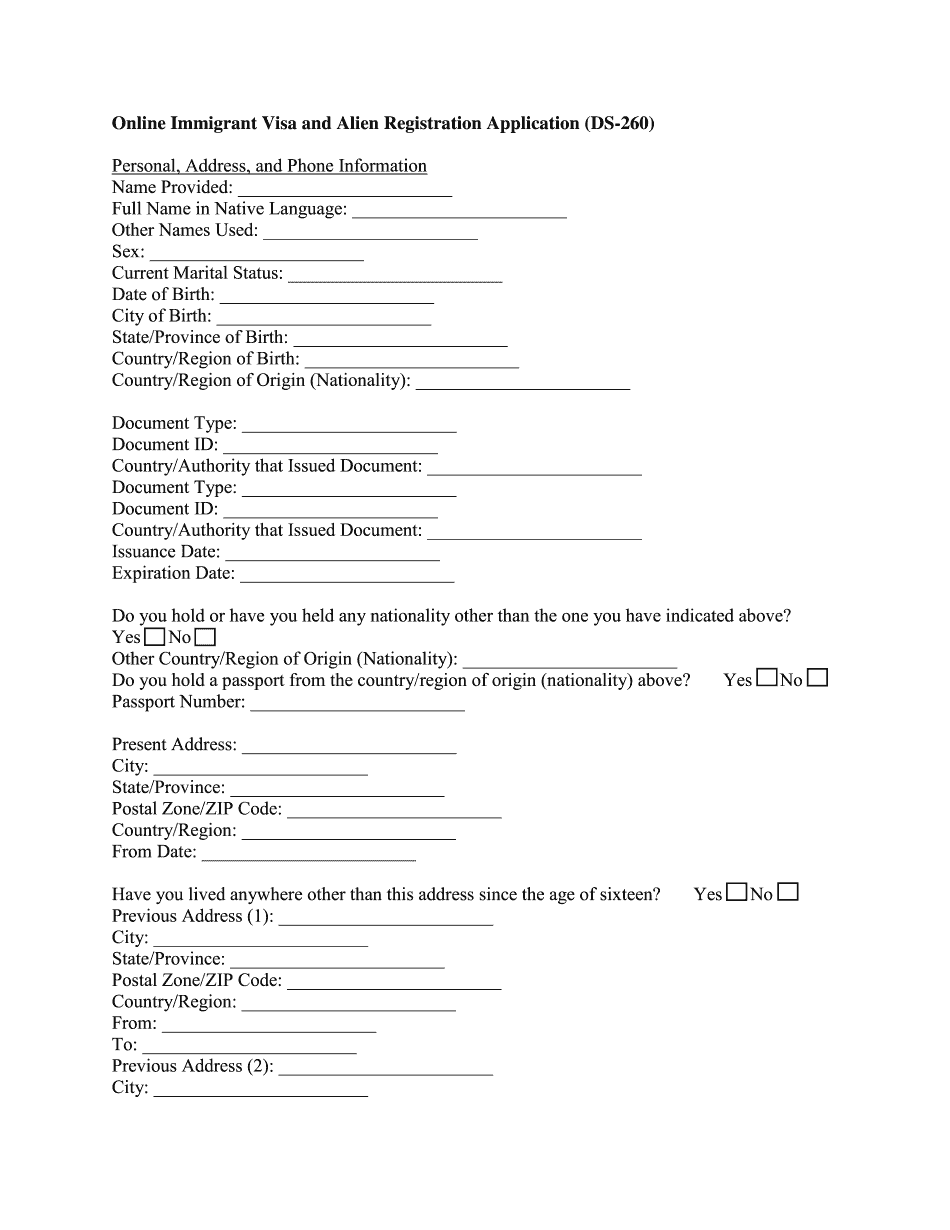

DS-260 Form: What You Should Know

Form 1099-B Instructions and Tax Reporting Tips — efile4Biz For the purpose of preparing U.S. tax returns, an “item” is any property (real, personal, or mixed) that you owned before the transfer. A “sale” occurs when you give up a portion of a trade to the acquirer and a “gift” occurs when your property is given away free of charge. The sale of stock is considered a sale, and the gift of stock is a gift. A Form 1099-B filing is required whenever a broker gives a company the opportunity to buy up to 50 percent of the business from you. You have a choice: File it in your own name or send a copy to your broker. File the Form 1099-B immediately after the sale, or file after the 10% sale limit. If you do it later, do it within a maximum time limit as prescribed by the instructions for the Form 1099-B, along with your completed and signed Form 1099-B or 1099-C at least 5-8 weeks before filing each year's report for that year. For a Form 1099-B that you file after 10% of a sales amount, do not need to complete Form 8886, because the 10% sale limit is not computed until you file your financial year's tax return, which is required on April 15 of the following year. What is 1099-B for 2018? As of May 2018, you have to file Form 1099-B if you received a gain on the disposition of at least 600, except in the case of a stock sale which is a gift. For a gift of stock in the form of stock options, the gift is a sale. Filing Form 1099-B is not required if you are a resident alien, or are married for certain tax purposes (married filing jointly) and a nonresident alien. What is Form 1099-B from a broker-dealer? As of May 2018, a corporation that has received a cash dividend from an S Corporation can claim a tax deduction for part of the dividend paid into a noncorporate tax-exempt fund, if you are, or include the S Corporation on Form 1120S, 1120E, or 1290. This is called a “tax-free distribution.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form DS-260, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form DS-260 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form DS-260 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form DS-260 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.