Hi everyone welcome back to my channel my name is liman and today we're going to talk about how you file this 360. uh when you when you use CIS approved your application they will send it to NVC and and the NVC will create your login information your login credential and and they will send it to you you your login credential is the case number and the invoice ID number when you click on the link they sent you it's going to take you to this page right here you cannot you can First You're Gonna check I have read the terms of the Privacy Act notice and then you enter your case number right here and then you hit continue the second page is gonna enter your invoice number right here and then you're gonna select the one that apply for you petitioner applicant attorney or third Asian party and then you're gonna answer the characters shown below and then you hit continue this is just a summary information they will talk they will you they will show your case number uh Visa class number in this case cr1 cr1 uh your case is currently at they will show you where the case is in this case it's going to be an NVC uh foreign state of chargeability which country and the interview location who is going to be and the priority date and this is where they communicate with you if they need something your email address we're gonna go to the next page they will show you right how this is processed First You're Gonna Pay both fees before you start filing this 260 and uploading the required document for the petitioner and for the applicants when you pay the fees you're gonna you're gonna...

PDF editing your way

Complete or edit your ds 260 form pdf anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export ds 260 application form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your ds 260 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your ds 260 form 2021 pdf by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form DS-260

About Form DS-260

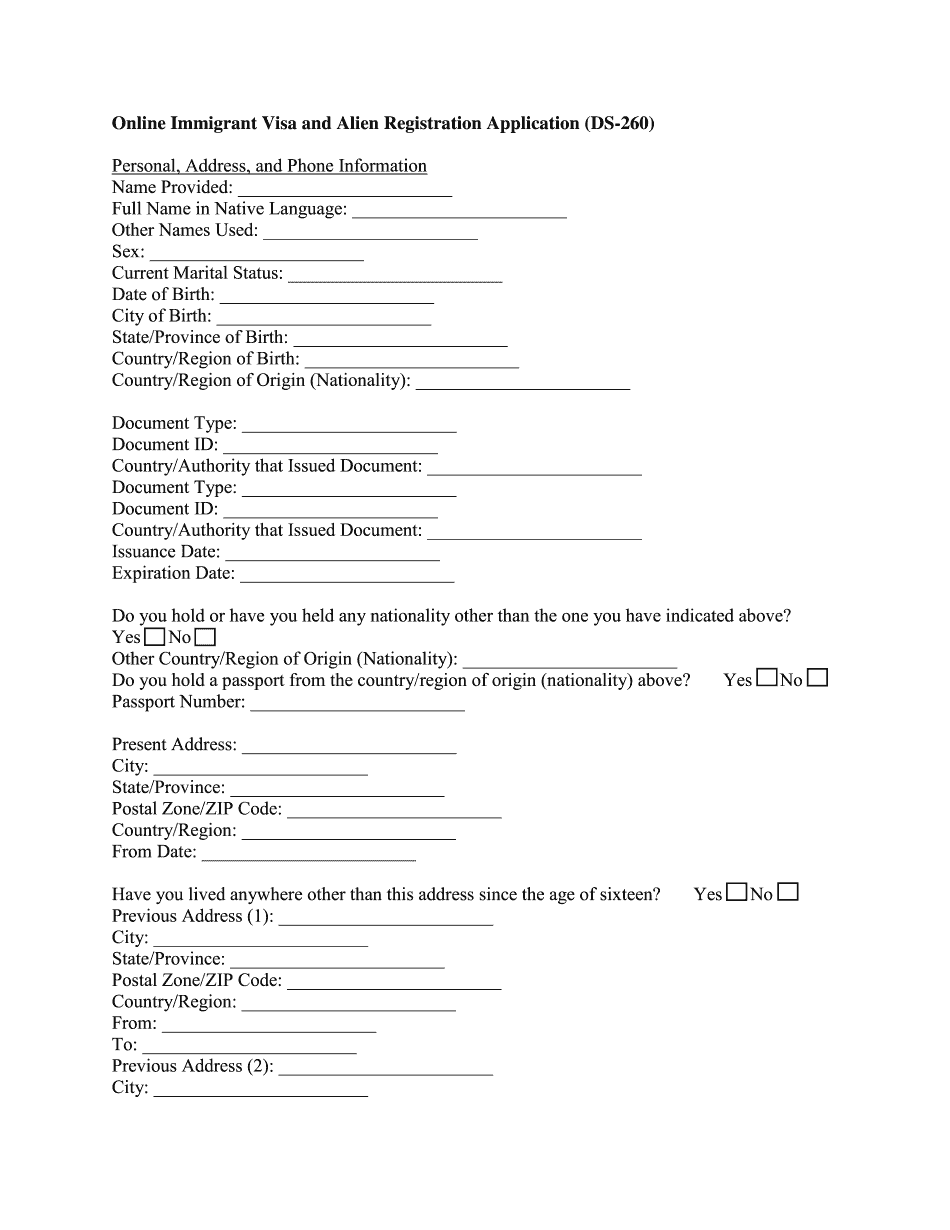

Form DS-260 is an online application form designed by the U.S. Department of State for immigrant visa applicants. It serves as a vital component of the visa application process and is used to gather information necessary for determining an individual's eligibility to immigrate to the United States. Any individual seeking an immigrant visa, including the Diversity Visa (DV) or family-sponsored visa, is required to complete Form DS-260. This applies to individuals who have received approval from the U.S. Citizenship and Immigration Services (USCIS) for a visa petition, such as an immediate relative or a fianc(e) of a U.S. citizen, as well as those who have been selected through the annual DV lottery. Form DS-260 allows applicants to provide relevant personal, educational, and professional details to the U.S. government. This information includes passport details, contact information, family members, previous addresses, employment history, and education qualifications. Applicants also have the opportunity to disclose any prior immigration or criminal history, if applicable. The purpose of this form is to enable thorough background checks and to ensure that individuals do not pose a security or health risk to the United States. Therefore, it is a critical step in the overall visa application process, facilitating the consular officers' evaluation of an applicant's eligibility for an immigrant visa. Completing Form DS-260 accurately and truthfully is essential, as any erroneous or misleading information can lead to visa denials or potential legal consequences. It is advisable to carefully review the instructions and gather all required documents before filling out the form to ensure a smooth and efficient visa application process.

What Is Ds 260 immigration form?

Each individual who is going to move to the U.S. for permanent residence has to seek for an immigrant visa. In order to implement this procedure each foreign citizen has to fill out a form DS-260 that is online Immigrant Visa and Alien Registration Application.

Sometimes other supplementary documents are required, but such form is one of the basic documents that the Department of State needs for evaluating an immigrant visa case.

This application form is usually submitted online to the State Department. All aliens under 14 years are incapable to fill out the form themselves. In this case a form is completed by alien`s parents or guardians.

Before filing an application an individual has to pay correct service fee. After the fee is paid, an individual has to prepare an application. On our site you may find a fillable ds-260 sample which can be filled out and further submitted to a recipient online. We offer you a wide range of editing tools in order to customize a document according to your requirements.

A form is presented by number of questions and fillable fields. Almost all fields are mandatory to be completed. An alien has to prsufficient information in order to have an application accepted and processed. An individual is required to include following details in a blank ds-260 form:

- personal data, i.e. full name, address, date and place of birth, nationality, passport details etc.

- details about family (i.e. parents, spouse, children);

- information about 5 previous visits to the U.S. (if any);

- details regarding work and education;

- social security number details.

After a document is complete, check it for mistakes and completeness of information to avoid any delays or rejections. Submit a document to the recipient for further verification of alien`s eligibility to obtain an immigrant visa. Once a document is accepted, a person will be emailed a confirmation. Remember that filing DS-260 is not the final step for receiving a visa. An individual further may be asked to come for the interview to a consulate taking with him/her a printed confirmation of filing a form.

Online choices make it easier to prepare your document administration and increase the productiveness of your workflow. Comply with the quick tutorial so that you can finish Form DS-260, refrain from glitches and furnish it inside a well timed manner:

How to accomplish a Form DS-260 internet:

- On the web site along with the sort, click Get started Now and pass towards the editor.

- Use the clues to fill out the applicable fields.

- Include your individual information and facts and get in touch with knowledge.

- Make absolutely sure that you just enter right data and quantities in best suited fields.

- Carefully take a look at the content material within the variety also as grammar and spelling.

- Refer to assist section for people with any inquiries or address our Assistance team.

- Put an electronic signature on your own Form DS-260 with all the assistance of Indication Resource.

- Once the form is concluded, press Completed.

- Distribute the completely ready type by way of e-mail or fax, print it out or preserve on your system.

PDF editor allows for you to make adjustments for your Form DS-260 from any internet related device, customize it as per your requirements, indication it electronically and distribute in various methods.

What people say about us

It's a great idea to distribute forms on the web

Video instructions and help with filling out and completing Form DS-260